This month, we hosted an online event to launch brand new research into mCommerce – where and how people spend money out of home on their mobile phones.

We were joined by Mindshare’s Chief Digital Officer, Alexis Faulkner, and Economist, Karl Thompson from Cebr as well as one of Kinetic’s Business Directors, Olivia Howard.

You can watch the full session here, or read on for the highlights.

The e- and mCommerce market

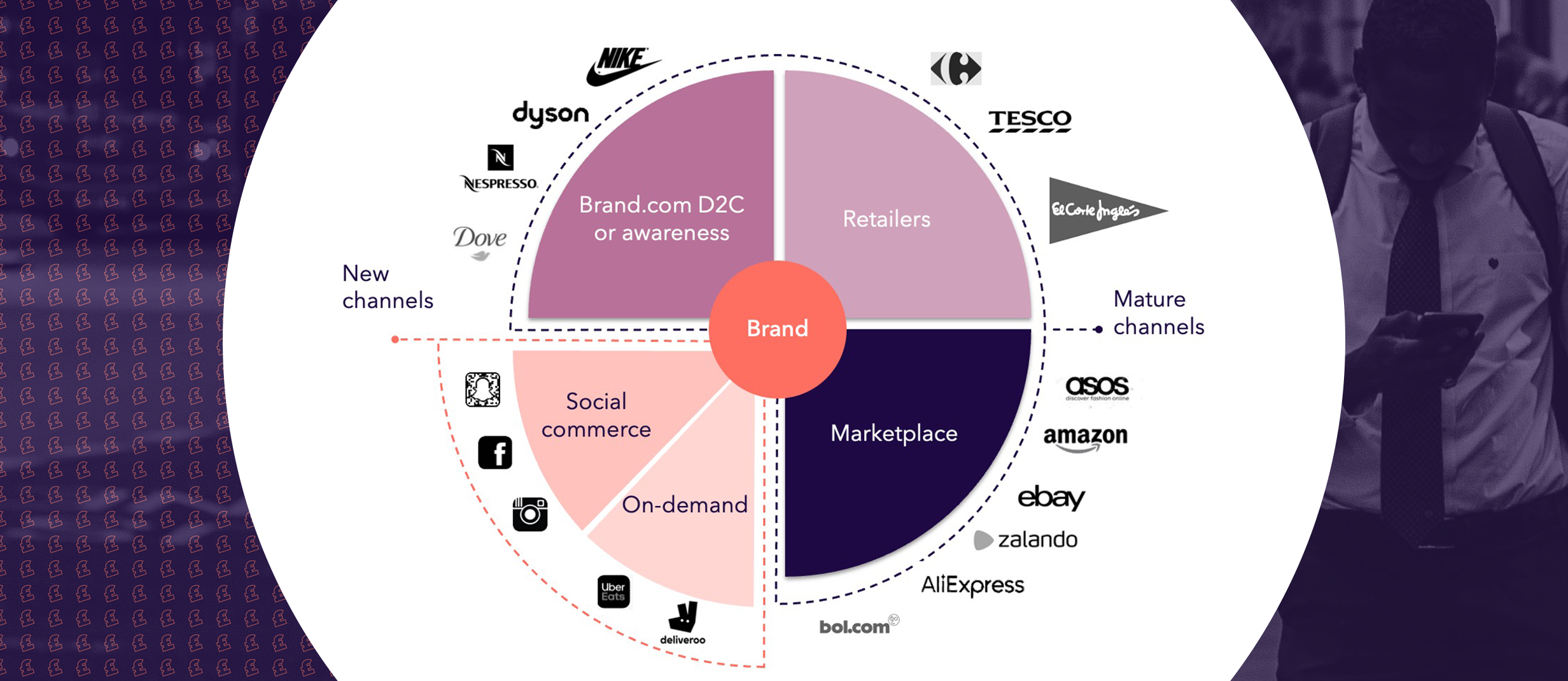

Retail is big business for the UK, but undergoing a period of immense change. During Covid, the eCommerce market grew enormously (46.5% in 2020 and 20.5% in 2021), with a third of UK spending expected to shift to online purchases permanently. While the pandemic has supercharged eCommerce and resulted in the closure of some stores, the two aren’t mutually exclusive. The purchase journey has evolved and is very interchangeable. We now have people seeking inspiration in store and purchasing online as well as people searching online and buying in store. We’ve also seen the continued rise of online platforms, including the likes of Amazon and ASOS.

Knowing your customer is critical

eCommerce provides more data and better opportunities to know consumers. Understanding how people interact with media enables rich, relevant conversations at different times of the day depending on shopping trends at those times. Data is critical, particularly when building a brand online. Geodata especially can be used to enable deeper connections with consumers based on where they’re living, working or moving to.

Consumers now have many different touchpoints where they can interact with brands. Brand strength and perception, customer service and content should be consistent across all of these touchpoints.

The Mobile Pound Study

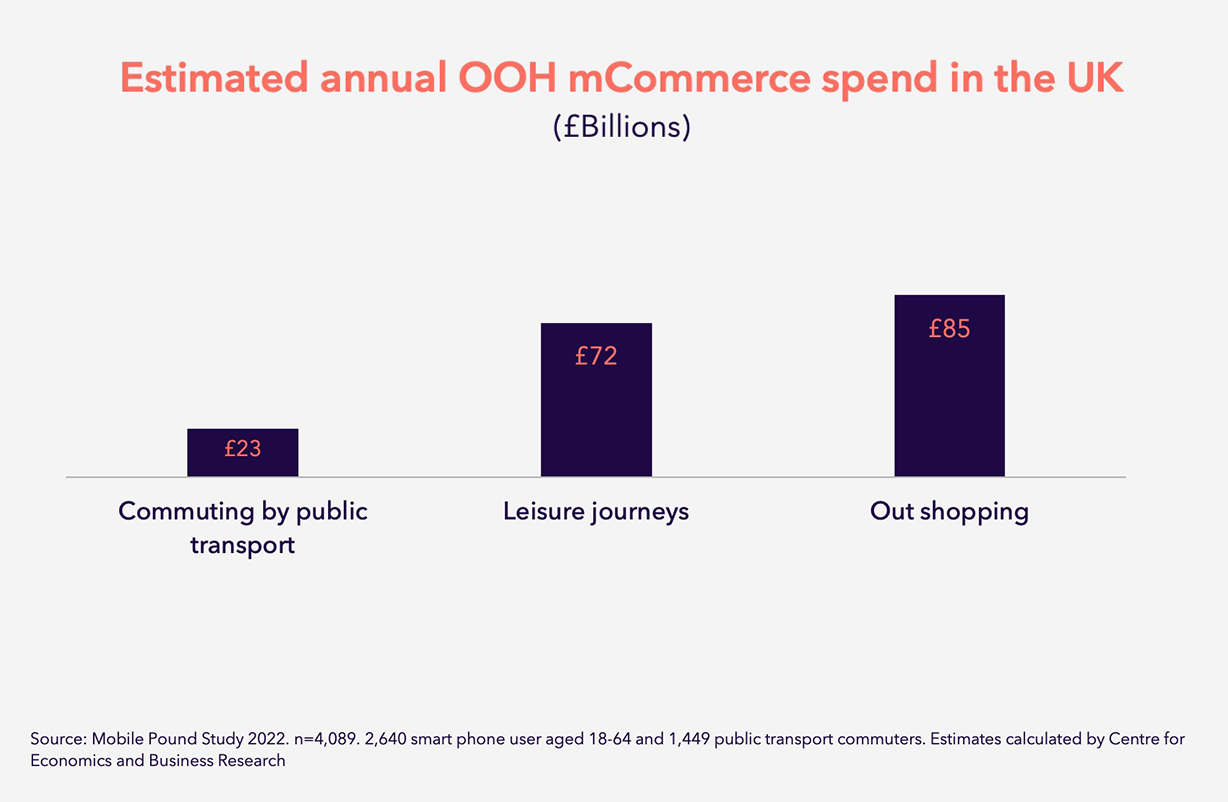

Out of home mCommerce is big business, worth an impressive £179bn, with a whopping 60% of all online spending done while people are outside of the home.

In partnership with Cebr, Global and JCDeaux, we looked at:

- The amount of money spent online while people are outside: travelling or shopping.

- 4000 interviews conducted during December 2021 with adults (18-64 year olds) who use public transport at least three times per week to commute to their place of work or full-time study.

- Individuals’ perceptions of their behaviours with the absence of Covid restrictions.

- Conclusions about the size and nature of the UK out of home economy, made by studying results on a regional basis and by out of home scenarios (commuting, leisure journeys and out shopping).

Our modelling points to total online spending growing steadily in the coming years, which will see out of home mCommerce grow even further.

People spend less money on the working commute than during leisure time

The research found that an eighth, or 13%, of out of home mCommerce takes place on the commute, amounting to £23bn per year, a figure unchanged from pre-pandemic estimates.

The remaining majority of mCommerce spending takes place during leisure time. Spending while out shopping makes up the largest component of out of home mCommerce overall at an estimated £85bn per year, accounting for half of all out of home mCommerce. The remaining £72bn comes from spending while on leisure journeys. As such, individual spending during leisure time stands far in excess of spending while commuting.

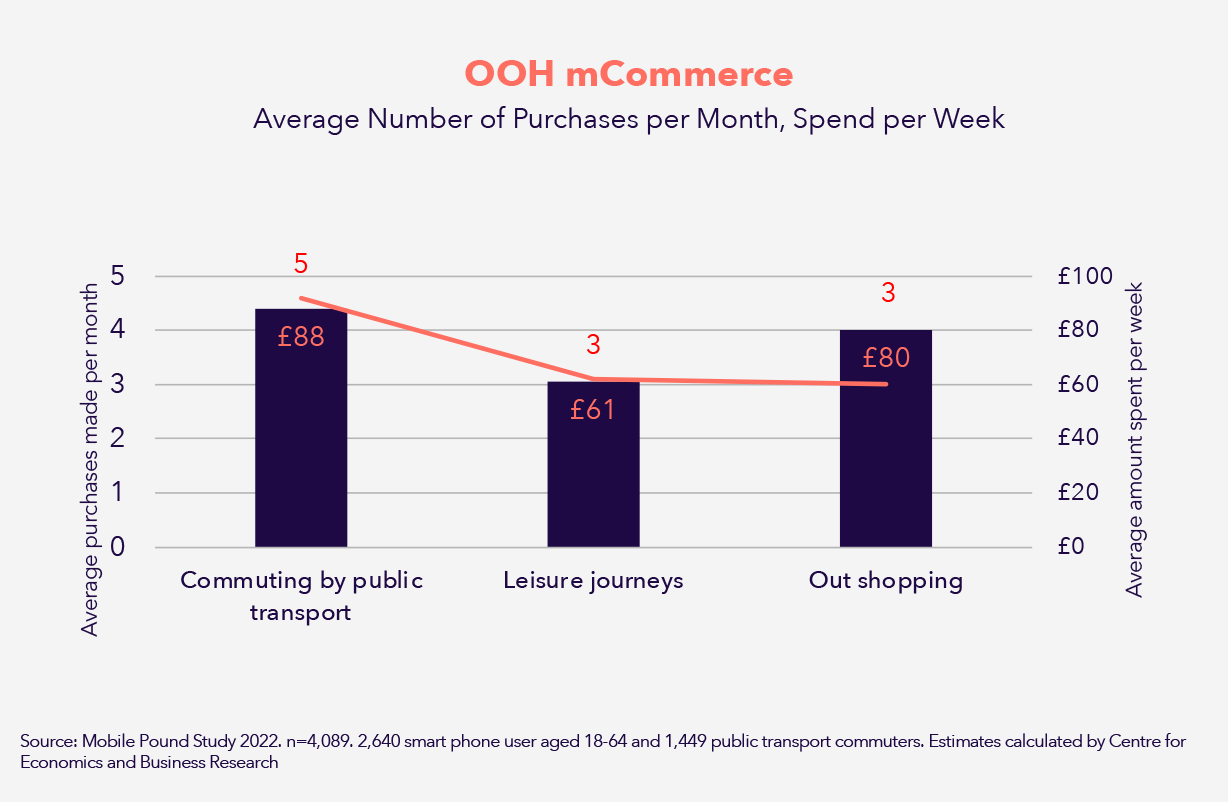

But people buy more frequently when they’re commuting

The research found that individuals make purchases more frequently when commuting than either leisure journeys or out shopping. The average commuter makes five online purchases per month while commuting, while the average adult makes three monthly purchases during leisure journeys, and a further three while out shopping.

Average weekly online spend is also highest among commuters. The average frequent commuter spends £88 online per week compared to £80 by the average individual out shopping and £60 during leisure journeys.

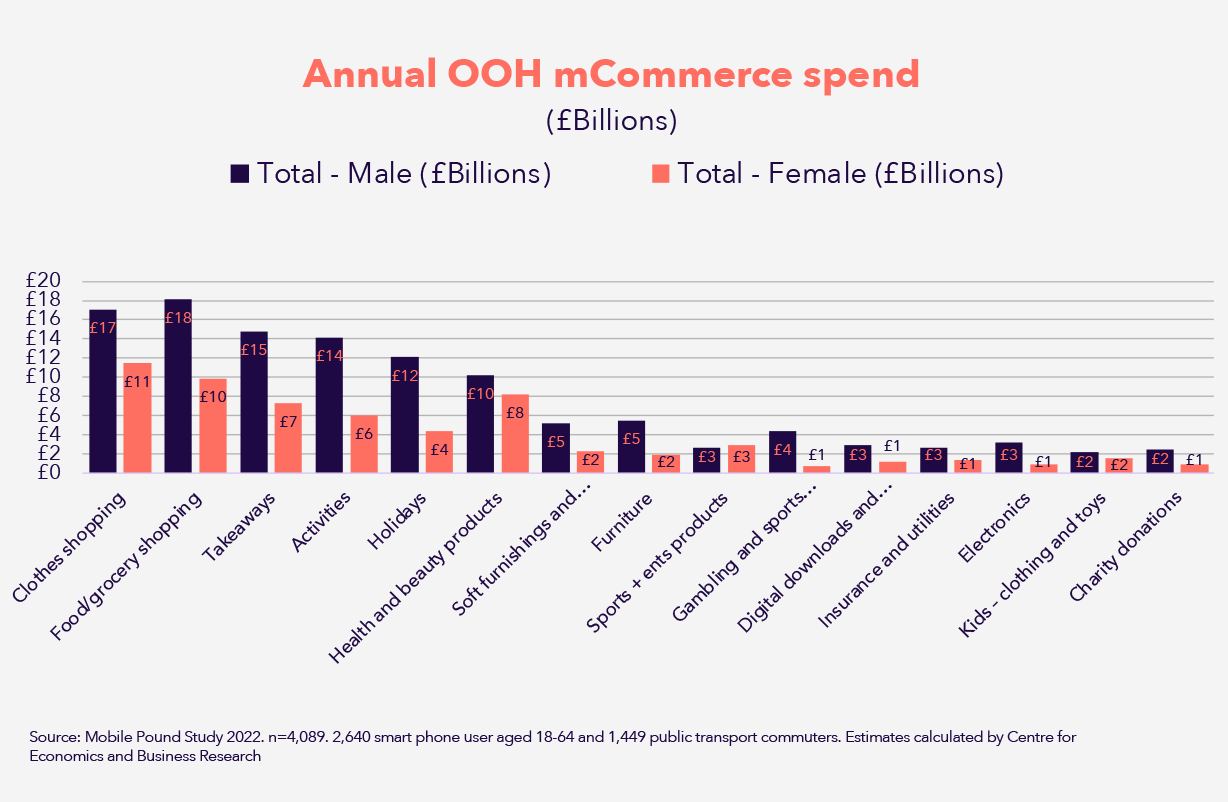

Who spends more outside of the home?

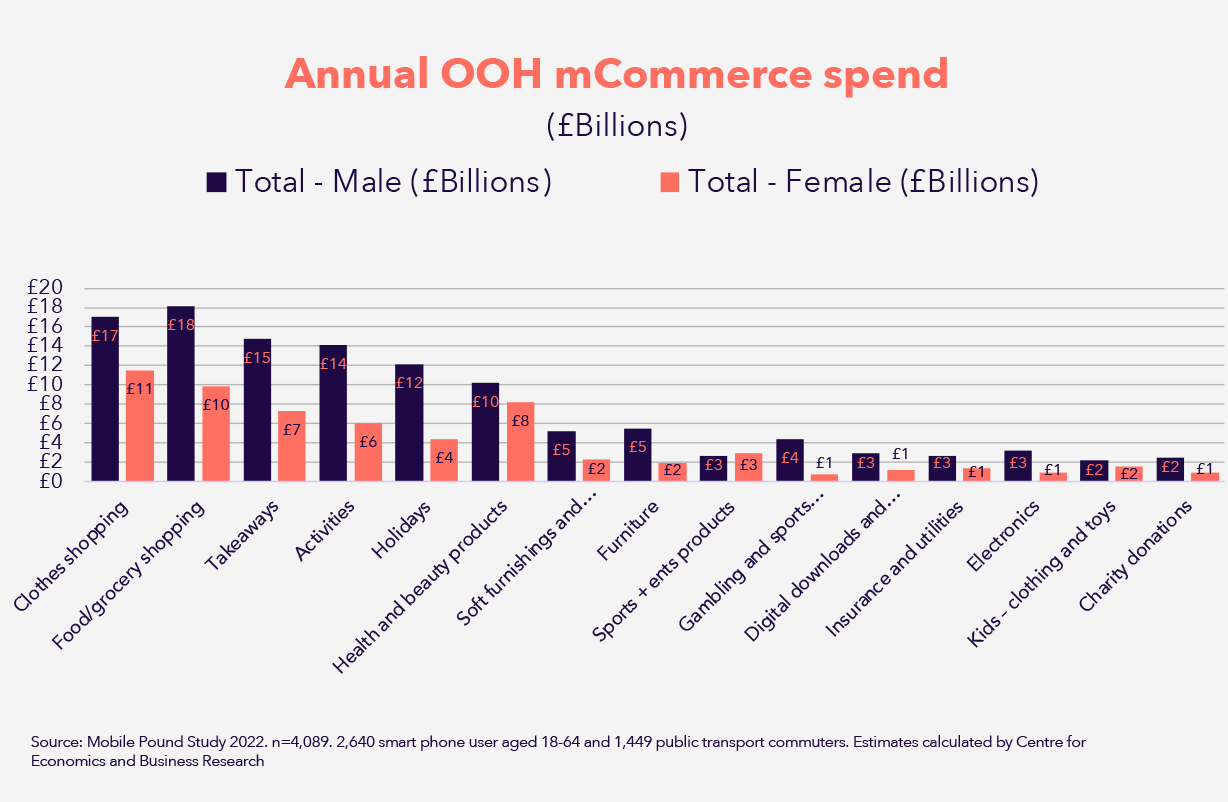

Interesting results were found when studying the findings from two demographic dimensions.

Men spend double on mCommerce compared to women while shopping out of home (£118bn per year vs £60bn). Though women make up a close majority of the adult working age population, this result is mainly due to much higher average spending among men.

18-34 year olds and 35-64 year olds spend roughly the same (£10bn) on activities (theatre, cinema, concerts etc) on their mobile devices out of home each year, despite there being almost twice as many 35-64 year olds than 18-34s.

18-34s spend more on clothes, shopping, health and beauty products and holidays. Meanwhile over 35s spend more on food, groceries and gambling and betting. But the starkest divide between the age groups is seen on holidays. 18-34s spend £10bn each year on holidays compared to £6bn among the much larger over 35s group.

Takeaways or Getaways?

A staggering £22bn is spent on takeaways via mobile devices out of home each year. This compares to just £16bn per year spent on holidays. While holidays are more expensive than takeaways, the lower overall spend on holidays is driven by the much higher frequency of takeaway purchases.

Five categories account for £2 in every £3 of out of home mCommerce spend

The analysis showed that the top five spend categories together account for £2 in every £3 spent outside of the home.

How can OOH help brands capture The Mobile Pound?

Advancements in OOH means its role and capabilities have broadened. OOH has always been effective at driving people in to a physical store. But the rise of mCommerce outside of the home is a huge opportunity for brands to use OOH advertising in a smarter and more creative way to increase purchase intent and drive sales online while people are out and about. In a world where a purchase can happen at any time and in any place when outdoors, OOH has become the virtual shopfront for brands with no stores.

OOH’s role is two-fold:

- Driving brand awareness to keep a product front of mind, which influences purchases over time, whether that purchase takes place in store or online.

- Acting as that final window of influence for a more immediate purchase

Omni-channel shopping is the new normal

Covid accelerated omni-channel shopping, with many people of all ages and demographics purchasing both online and in store depending on what they want to buy and when they need it.

A recent NY Times article revealed that over the past two years, many DTC brands opened physical stores to display their products, realising how important a physical presence can be in driving in-person and online sales.

This is supported by research from CACI called The Halo Effect which revealed that online sales are 106% higher within a store’s catchment area. For consumer electronics, fashion and sportswear this is significantly higher at 120%.

How can OOH take advantage of new shopping behaviour?

1. Geo behavioural data helps us to plan smarter

Using our Journeys platform, we can segment audiences based on their online and offline purchasing behaviour by category. We can also identify locations, environments and frames that they are most likely to see.

Through a combination of Journeys and Touchpoints we can also overlay insights into mood and mindset. Brands can capitalise on the rising mood when someone goes out shopping or begins their journey home from work. A far more effective way to drive positive brand associations. This allows us to plan smarter on OOH by location, time and mindset.

2. Contextual messaging works harder to drive action

To encourage a person to make a purchase while out of the home, the messaging needs to resonate with the audience. The most effective way for brands to connect with audiences is to make full use of the flexibility of DOOH and the latest technology available.

Dynamic messages and QR codes are excellent tools when delivering contextually relevant and engaging messaging – which can be acted on in the moment. This includes changing messaging by location, time of day, mindset or purchasing behaviour (online or offline) to trigger action in a consumer.

3. Less faff, more spend

It’s important to be creative and make use of advancements in technology. The pandemic brought about the return of the QR code and a familiarity among all ages and demographics with scanning.

We’ve seen a rise in QR and other brand codes being featured on OOH campaigns to create an instant purchase opportunity for a consumer as well as acting as portals to rich brand content. This frictionless commerce experience is only set to grow and become more commonplace on OOH ads for many categories and brands.

We will be sharing more on The Mobile Pound study and online behaviours outside of the home in the coming months. For more information please email Nicole Lonsdale (Chief Client Officer), Sarah Robinson (Head of Insight) or your usual Kinetic contact.